What Is Mat Tax Rate

Tax computed as per the mat provision on book profit 18 5 tax rate plus surcharge and education cess as applicable applicability of mat minimum alternate tax or mat is only applicable to companies and not to individuals hufs partnership firms etc.

What is mat tax rate. Rules pertaining to section 115ja are applicable to foreign companies that generate profits. Also mat credit and carry forward provisions were dropped though taxpayers were allowed to utilise the mat credit they had carried forward from earlier years. In india mat is levied under section 115jb of the income tax act 1961. Mat a brief introduction.

The corresponding tax similar to mat but imposed on individuals or non corporate entities who claim certain deductions under the it act deduction under section 80h to 80rrb except 80p deduction under section 35ad and deduction under section 10aa is known as alternate minimum tax amt. Mat is levied on book profit unlike normal corporation tax which is levied on taxable profit. Mat is a tax provision reintroduced in 1997 in an attempt to bring zero tax high profits companies into the income tax net. The concept of mat was introduced to target those companies that make huge profits and pay the dividend to their shareholders but pay no minimal tax under the normal provisions of the income tax act by taking advantage of the various deductions and exemptions allowed under the act.

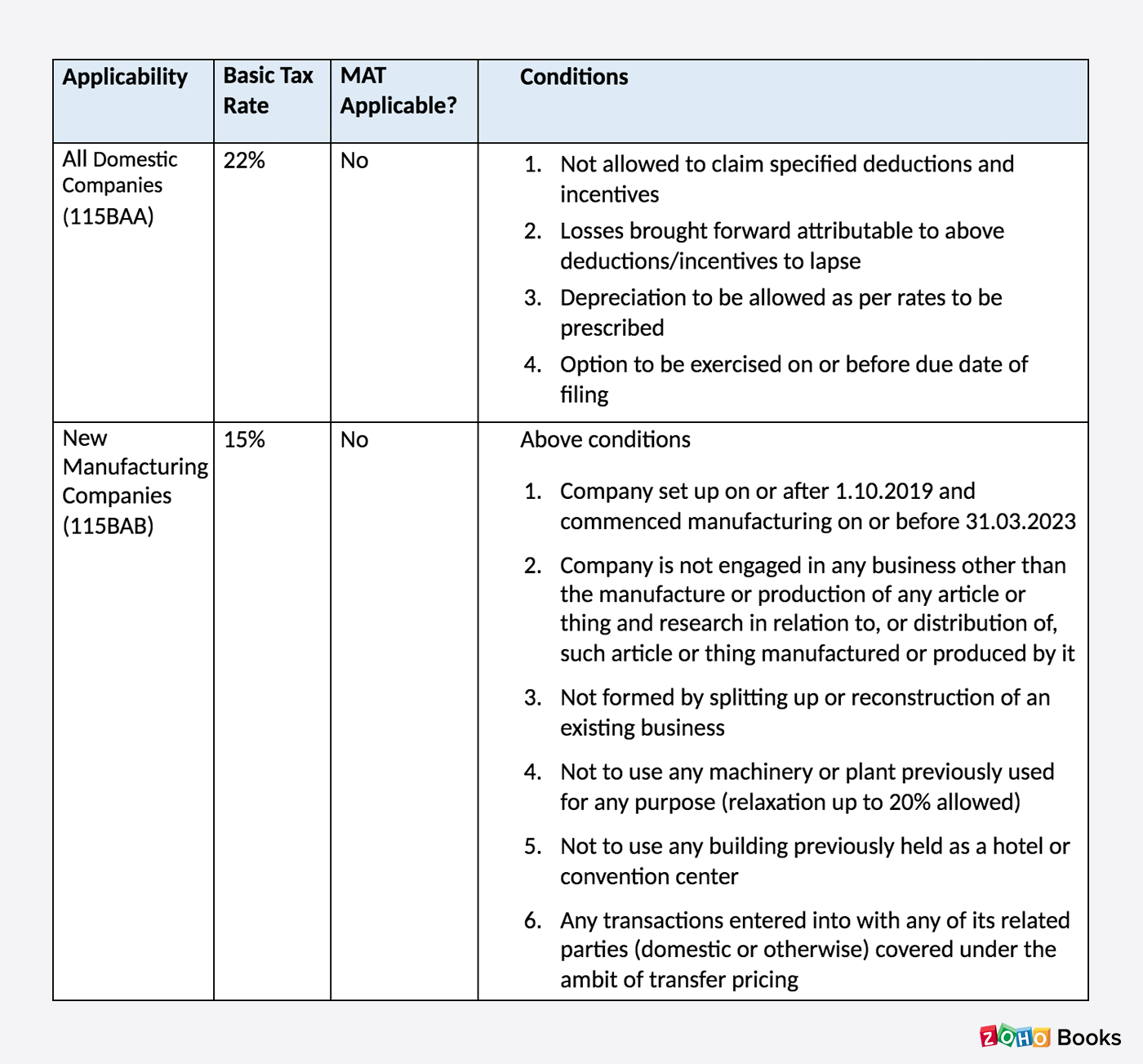

Tax computed at 15 previously 18 5 on book profit plus cess and surcharge. Minimum alternative tax is payable under the income tax act. With mat companies have to pay up a minimum amount of tax to the government. Tax rates the corporate tax rate and the mat rate and consequently two tax liabilities which a company has to compute compare and then pay the higher of the two.

The promulgated ordinance reduced the mat rate of tax for ay 2020 21 to 15 per cent but did not amend section 115jaa related to mat credit. Minimum alternate tax mat. It was introduced in the year 1987 and. The rate of amt is also at 18 5.

In september 2019 the government reduced the mat tax rate from 18 5 per cent to 15 per cent while also slashing the corporation tax rate to 22 per cent from 30 per cent. Tax computed as per the normal provisions of the income tax law i e by applying the relevant tax rate to the taxable income of the company. Income tax rates are decided and governed by income tax act 1961 and are subject to change every year.