What Is Mat Credit Entitlement In India

The total mat paid during the tax holiday period is available as mat credit to be adjusted against the regular tax liability at a later point.

What is mat credit entitlement in india. If this circumstance does not arise and mat credit stays in the loans and advances column of the company s balance sheet till the end of the specified period after which it is simply written off. The asset may be reflected as mat credit entitlement. The maximum amount of mat credit that you can claim cannot exceed the difference between the normal tax liability and the mat liability in the year for which the mat credit is being availed. As per the law this credit say rs 150 crore can be used to lower the regular tax liability at the end of the tax holiday.

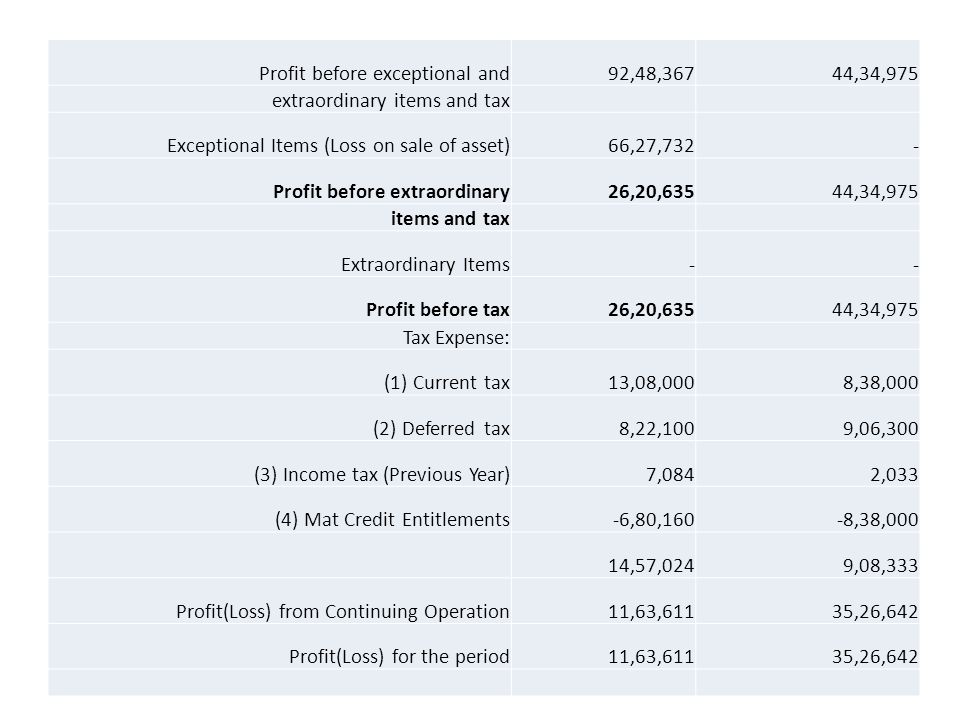

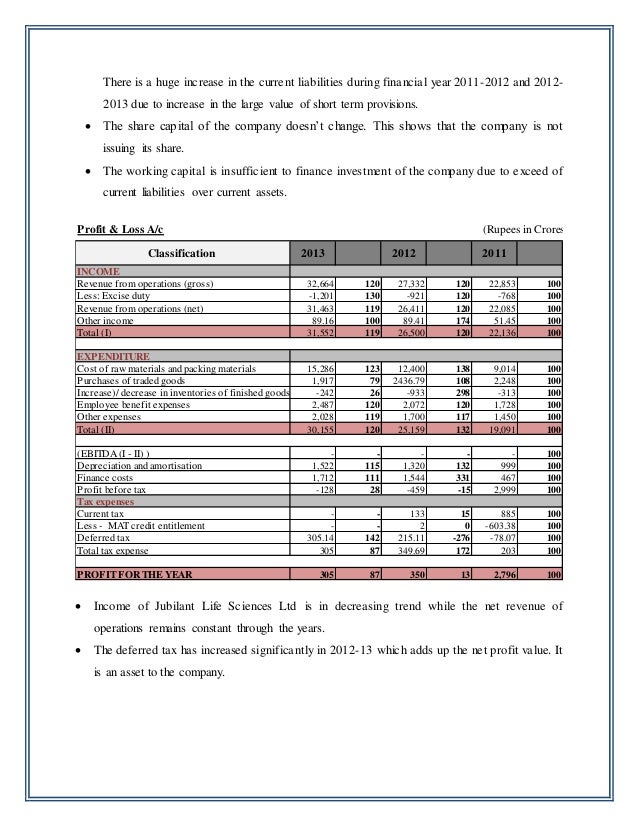

10 lakh while that as per the. Rs 14 43 000 rs 12 48 000 rs 1 95 000. Accordingly the tax expense arising on account of payment of mat should be charged at the gross amount in the normal way to the profit loss account in the year of payment of mat. A tax credit scheme is introduced by which mat paid can be carried forward for set off against regular tax payable during the subsequent fifteen years period subject to certain conditions as under when a company pays tax under mat the tax credit earned by it shall be an amount which is the difference between the amount payable under mat and.

If a company has mat credit of rs. 1 lakh the tax liability as per the normal provisions for fy 2019 20 is rs. This is with effect from ay 2018 19 prior to which mat could be carried forward only for a period of 10 ays.