What Is A Pooled Trust In Ct

It is also the only type of special needs trust that an individual can establish for themselves.

What is a pooled trust in ct. A pooled trust is a special type of trust that allows individuals to become financially eligible for public assistance benefits while preserving their resources in trust for supplemental needs. Plan creates a highly personalized one on one trust administrator relationship per client. Following is a listing of pooled trusts around the nation. The plan pooled trust is the only trust in connecticut that can be used by an individual over the age of 65 who has a disability.

Plan of ct pooled trust planned lifetime assistance network of connecticut inc p o. A pooled trust is a trust established and administered by a non profit organization. They can t afford to spend down and they certainly can t afford to pay for care out of pocket. Enter the pooled income trust.

1 350 for 2. A pooled trust is a type of common fund where people have accounts representing their contributions to the fund. What is a pooled trust. A separate account is established for each beneficiary of the trust but for the purposes of investment and management of funds the trust pools these accounts.

Box 290937 wethersfield ct 06129 860 523 4951 793 beneficiaries 1 000 or 9 million assets morgan stanley account bank of america 75 month recurring funding 1 050 for 1 client trust. This set up was originally intended to help disabled people with excess assets where a special needs trust seemed too expensive or slow or complicated. In new york state income deposited by disabled individuals into a pooled income trust is disregarded for the purpose of determining their medicaid budget. A pooled trust also known as a d 4 c trust is a special needs trust with a twist.

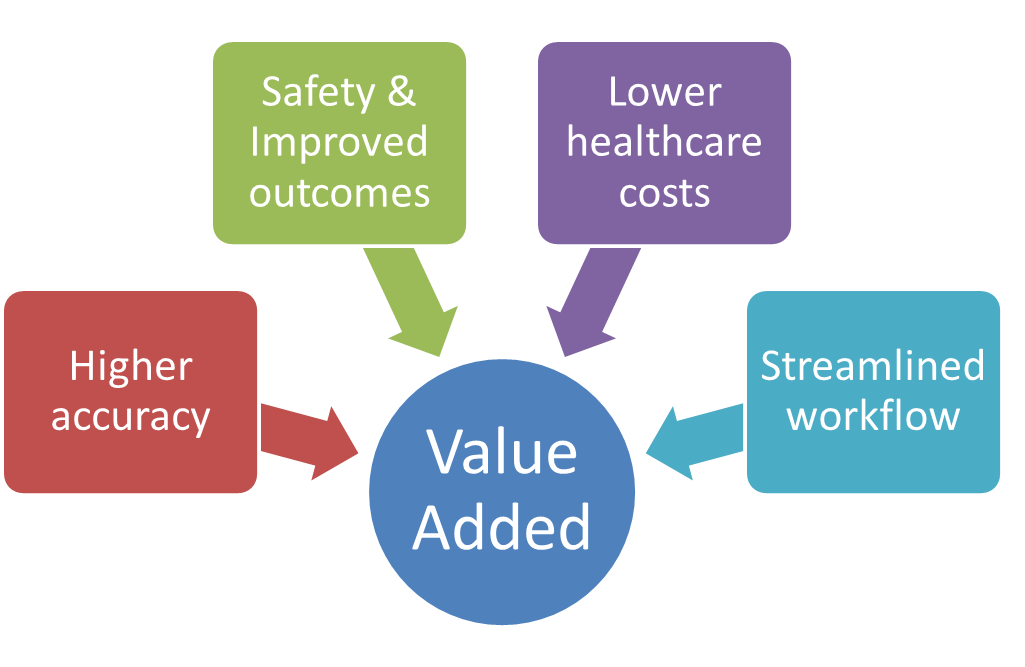

What are the benefits of a pooled trust. The plan pooled trust allows an individual with a disability to fund a trust account with his or her own assets retain a lifetime benefit from those assets and still qualify for government benefits like medicaid and supplemental security income ssi. Although a pooled trust is an option for an individual over age 65 who is receiving medicaid or ssi those over age 65 who make transfers to the trust may incur a transfer penalty depending on their state of residence.