What Does Kyc Mean In Banking

Kyc is especially important to prevent long term damage to a business.

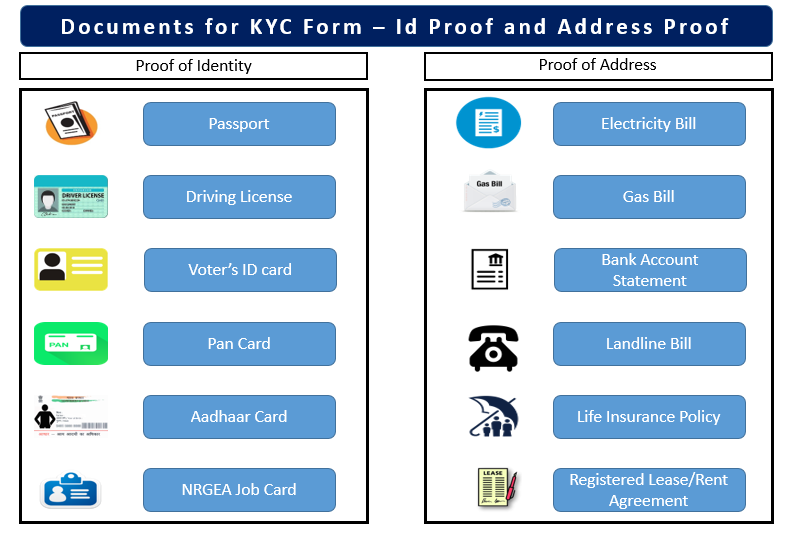

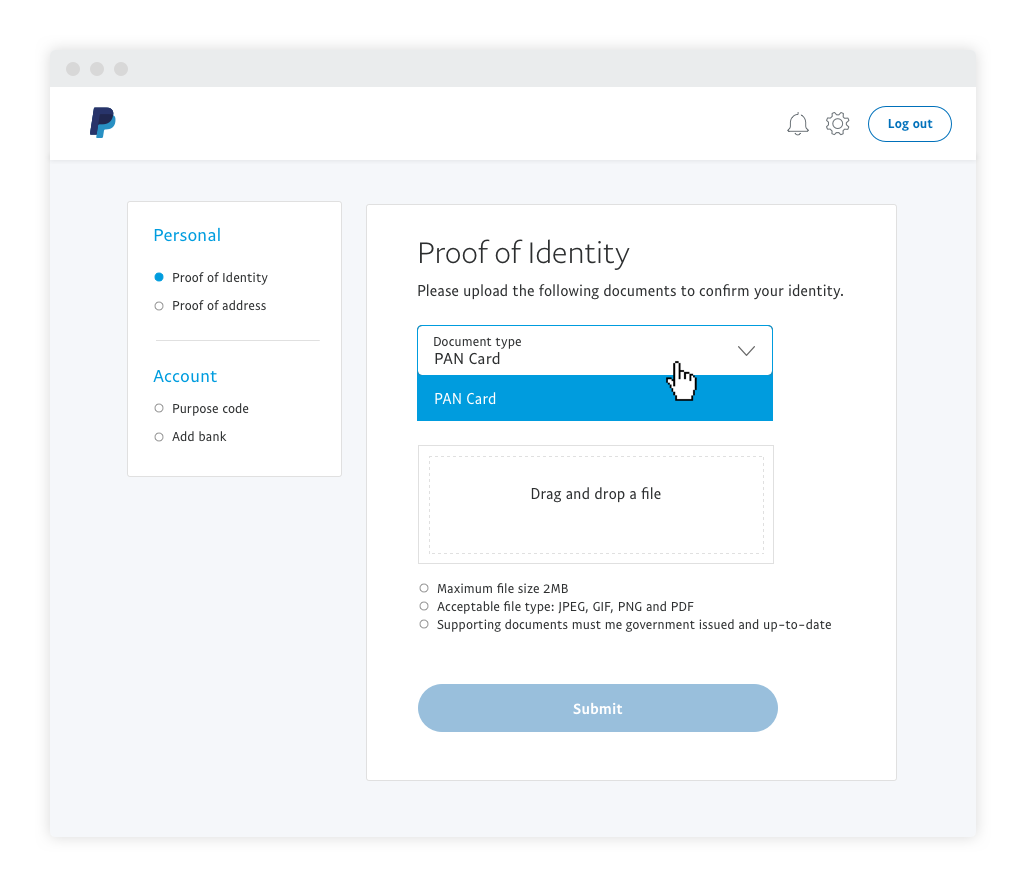

What does kyc mean in banking. The kyc form helps ensure that an investment adviser or broker does not make decisions that do not conform to the client s intentions. Kyc processes are also employed by companies of all sizes for the purpose of. Kyc norms regulate the collection of relevant information that your bank must obtain from you for the purpose of opening a bank account or doing business with you. Banking kyc abbreviation meaning defined here.

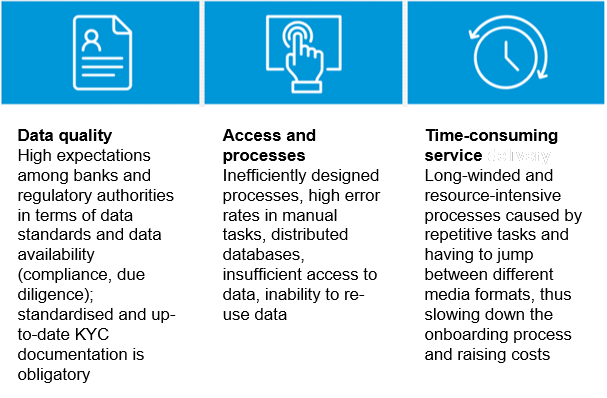

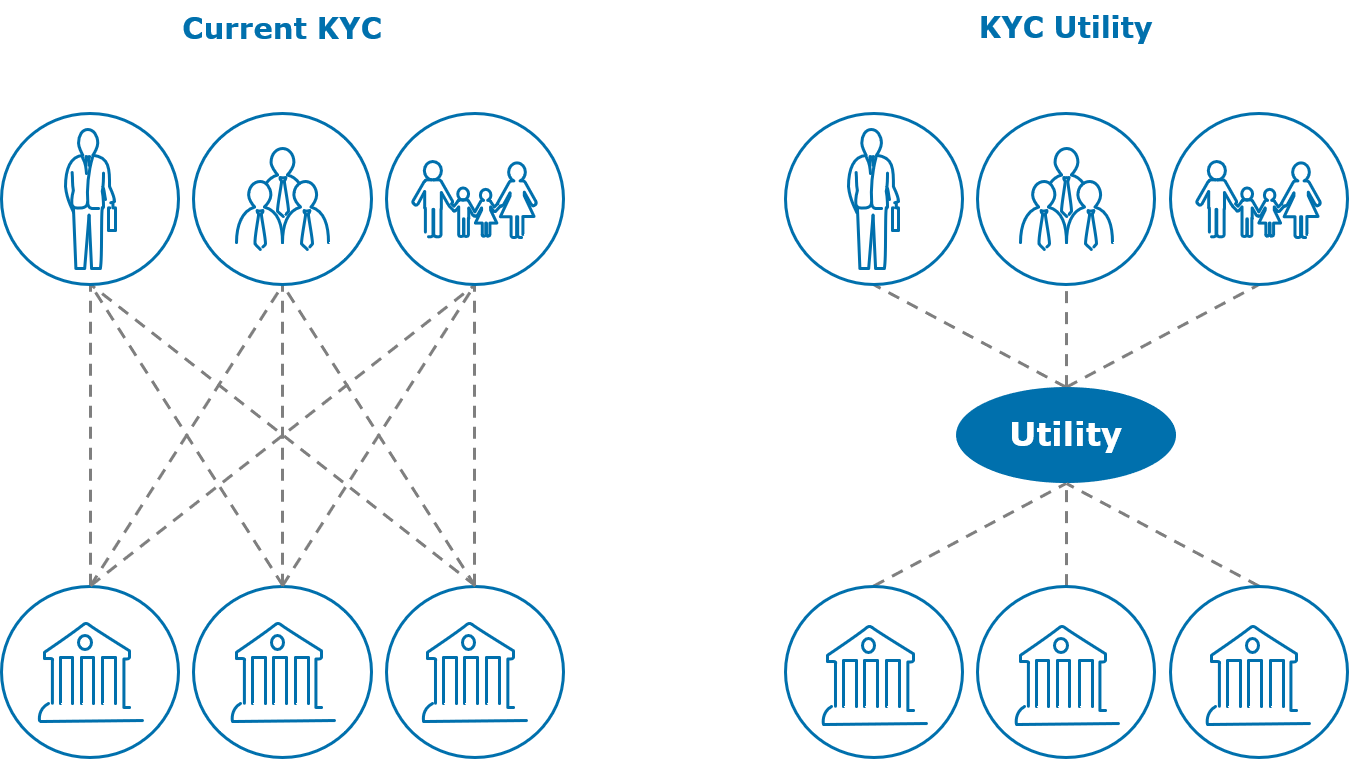

What does kyc stand for in banking. The money laundering terrorist financing and transfer of funds regulations 2017 says that all businesses need anti money laundering. The know your customer or know your client kyc guidelines in financial services requires that professionals make an effort to verify the identity suitability and risks involved with maintaining a business relationship the procedures fit within the broader scope of a bank s anti money laundering aml policy. The process of knowing your customer otherwise referred to as kyc is what businesses do in order to verify the identity of their clients either before or during the time that they start doing business with them.

This is a part of their ongoing due diligence on bank accounts. This will mean that customers transfer to a competing bank. Know your client a form containing detailed information on the risk tolerance and investment goals of the client of a brokerage. Get the top kyc abbreviation related to banking.

The know your client kyc rule is an ethical requirement for those in the securities industry who are dealing with customers during the opening and maintaining of accounts. The objective behind kyc or know your customer is to prevent money laundering financial fraud and other fraudulent activities. Money laundering and terrorist financing often relies on anonymously opened accounts and the increased emphasis on kyc regulation has led to increased reporting of suspicious transactions though this doesn t necessarily mean there s more bad activity out there just better detection of it. Banks are required to periodically update kyc records.

Why does my bank insist on doing kyc again. Allowing a criminal access to services can do a lot of damage to reputations. Periodical updation of records also helps. Although the phrase know your customer may seem insignificant to most people it has a very important meaning in the business world.