Wells Fargo Annuity Interest Rates

The special rates require you to deposit at least 5 000.

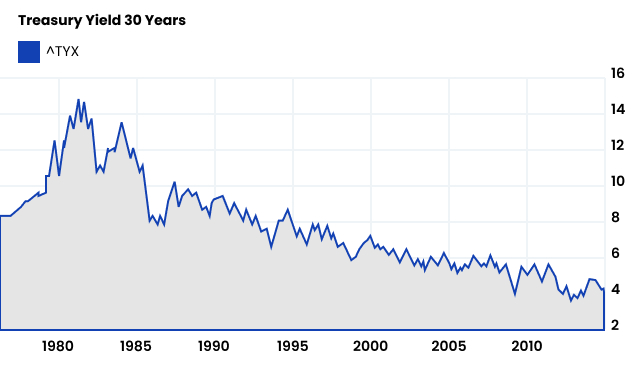

Wells fargo annuity interest rates. Following a settlement made with attorneys general in all 50 states customers harmed by wells fargo s practices could undergo a review and find that they re eligible for financial relief if. Fixed annuities may have a higher initial interest rate which is guaranteed for a limited time period only. Check back periodically as we regularly add new rates pages. You can also earn bonus rates on these.

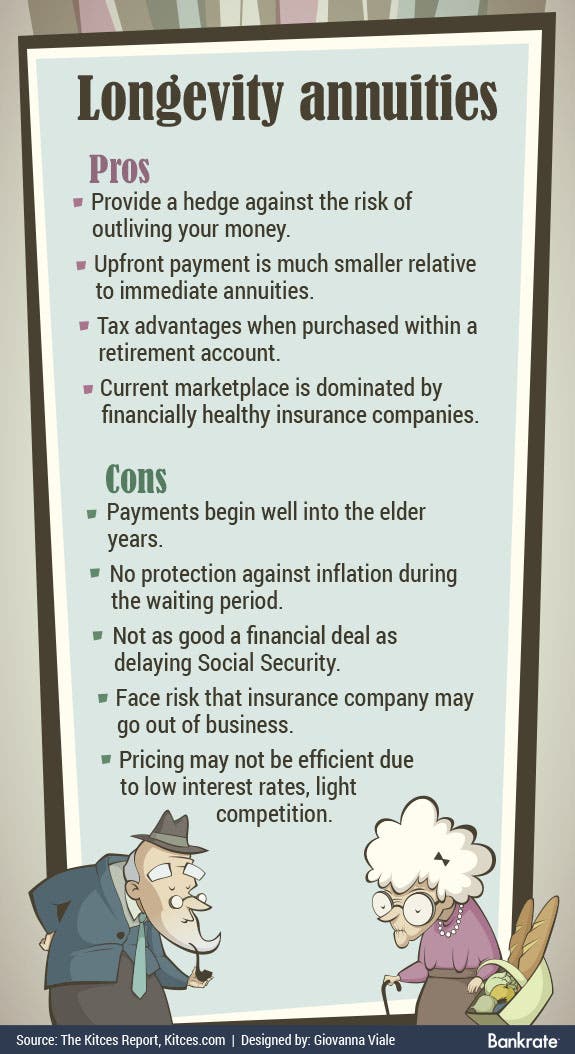

Guaranteed lifetime income with an annuity. The best myga rate is 3 percent for a 10 year surrender. At the end of the guarantee period the contract may renew at a lower rate. Product interest rate apr.

7 8 year annuity rates. Fixed annuities may have a higher initial interest rate which is guaranteed for a limited time period only. The standard rates require you to deposit 2 500. At the end of the guarantee.

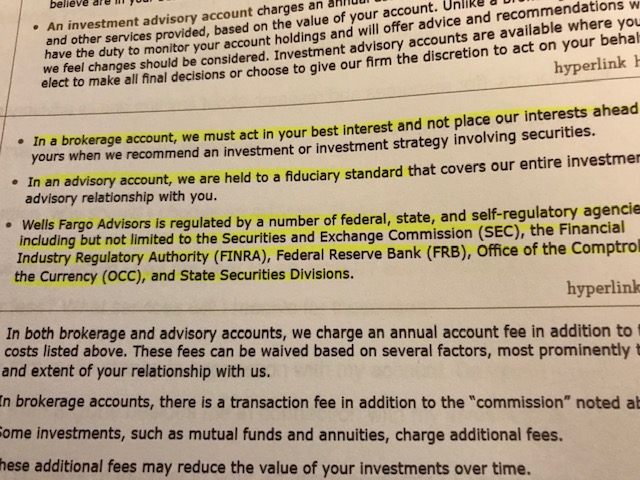

The insurance company offering the annuity sets and guarantees the rates. Conforming and government loans. Look up current rates on a variety of products offered through wells fargo. Wells fargo advisors is a trade name used by wfcs and wells fargo advisors financial network.

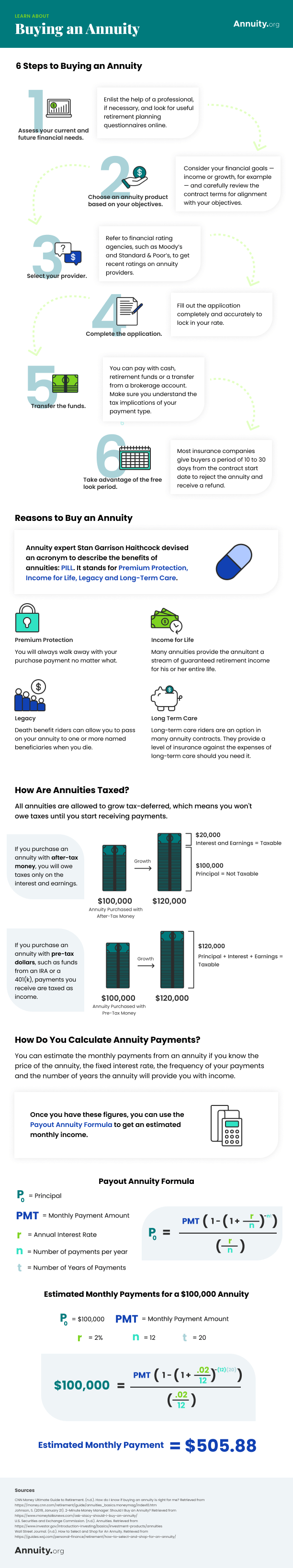

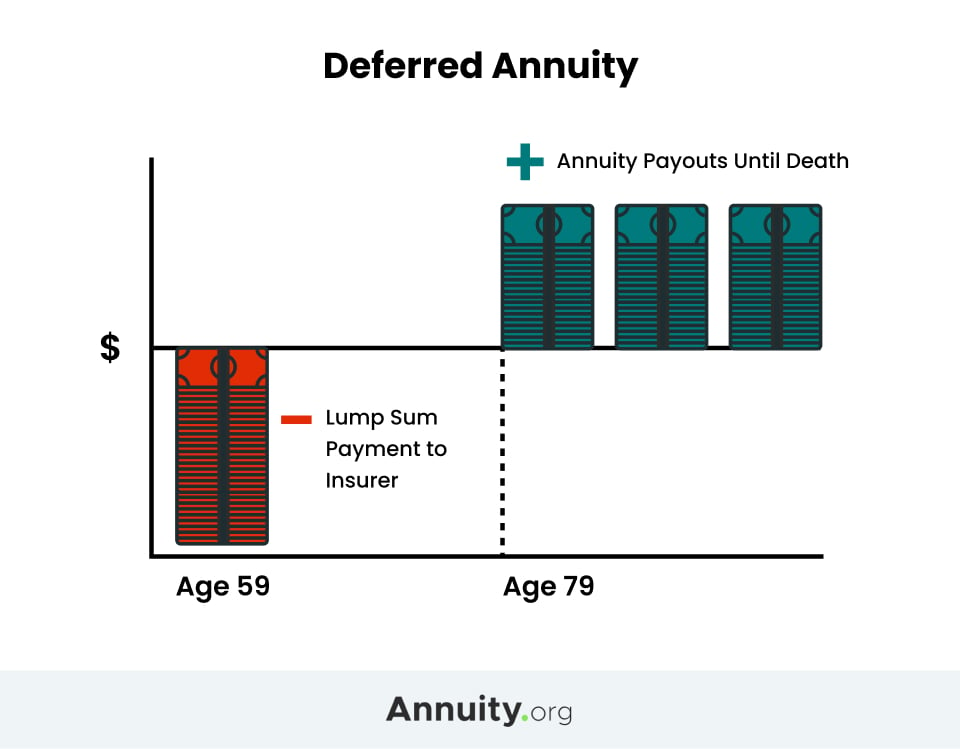

Use this chart to compare five popular types of annuities that can help you generate guaranteed lifetime income or potentially grow and protect your savings for retirement. Fixed annuities may have a higher initial interest rate which is guaranteed for a limited time period only. Wells fargo company and its affiliates do not provide. Investing in an annuity offered by wells fargo can provide guaranteed income for a specific period of time or for the rest of your life.

B has the highest 7 year rate of 3 20. Guaranteed lifetime income and tax deferred savings. Sentinel security life a m. At the end of the guarantee period the contract may renew at a lower rate.

Multi year guaranteed annuities or mygas are a type of fixed annuity that guarantees a fixed interest rate for a specified time period usually one to 10 years and is subject to fees called surrender charges that an annuity holder must pay if he or she withdraws money from an annuity before the specified time period is over.